Improving lender engagement

Key results

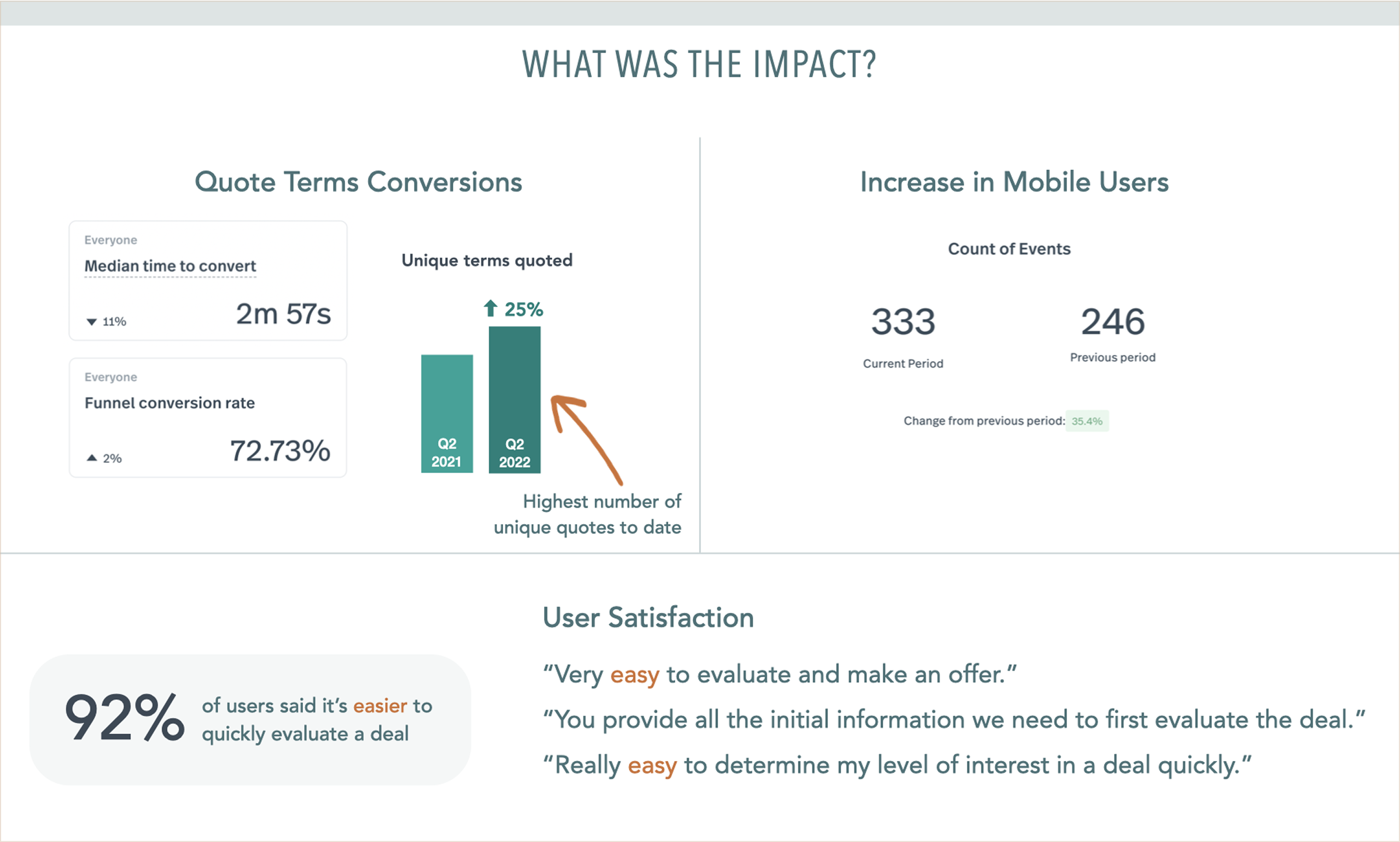

- Achieved highest number of unique quotes to date after launch

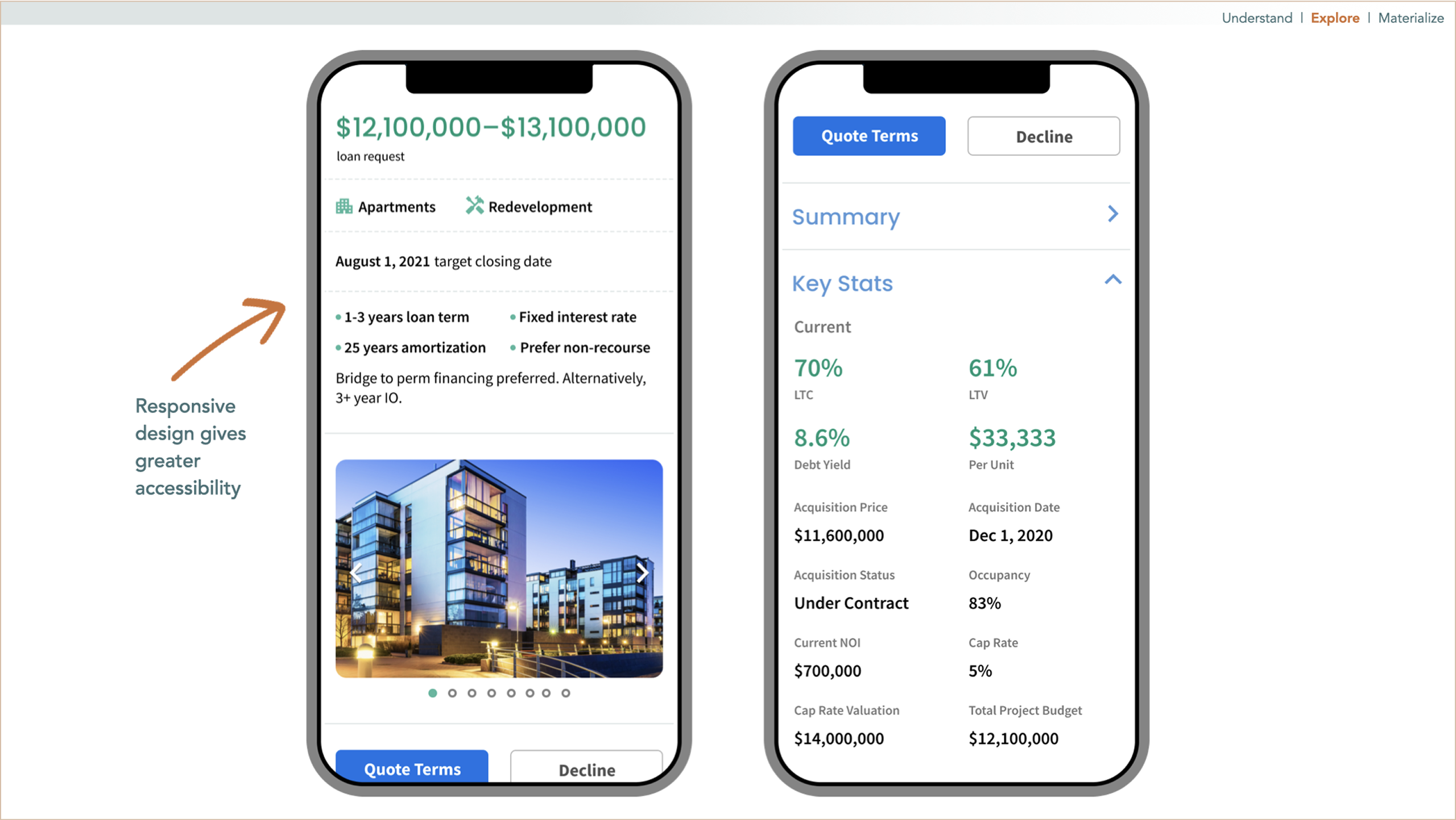

- Increased mobile user adoption with responsive design

- Surpassed $1 billion in closed deals through improved platform

Day one

On my first day at StackSource, I interviewed Tim, our CEO, about StackSource's purpose and business goals. While talking about business priorities, he said one thing that particularly struck me: 'We want to be the easiest way to get a commercial loan.'

Commercial real estate brokering can be pretty complex. A majority of deals have unique factors that prevent them from fitting neatly into a pre-defined structure.

My job was to take this complex process, make it faster and easier for our users with innovative technology, and add business value that ultimately resulted in StackSource surpassing $1 billion in closed deals.

Understand the product and users

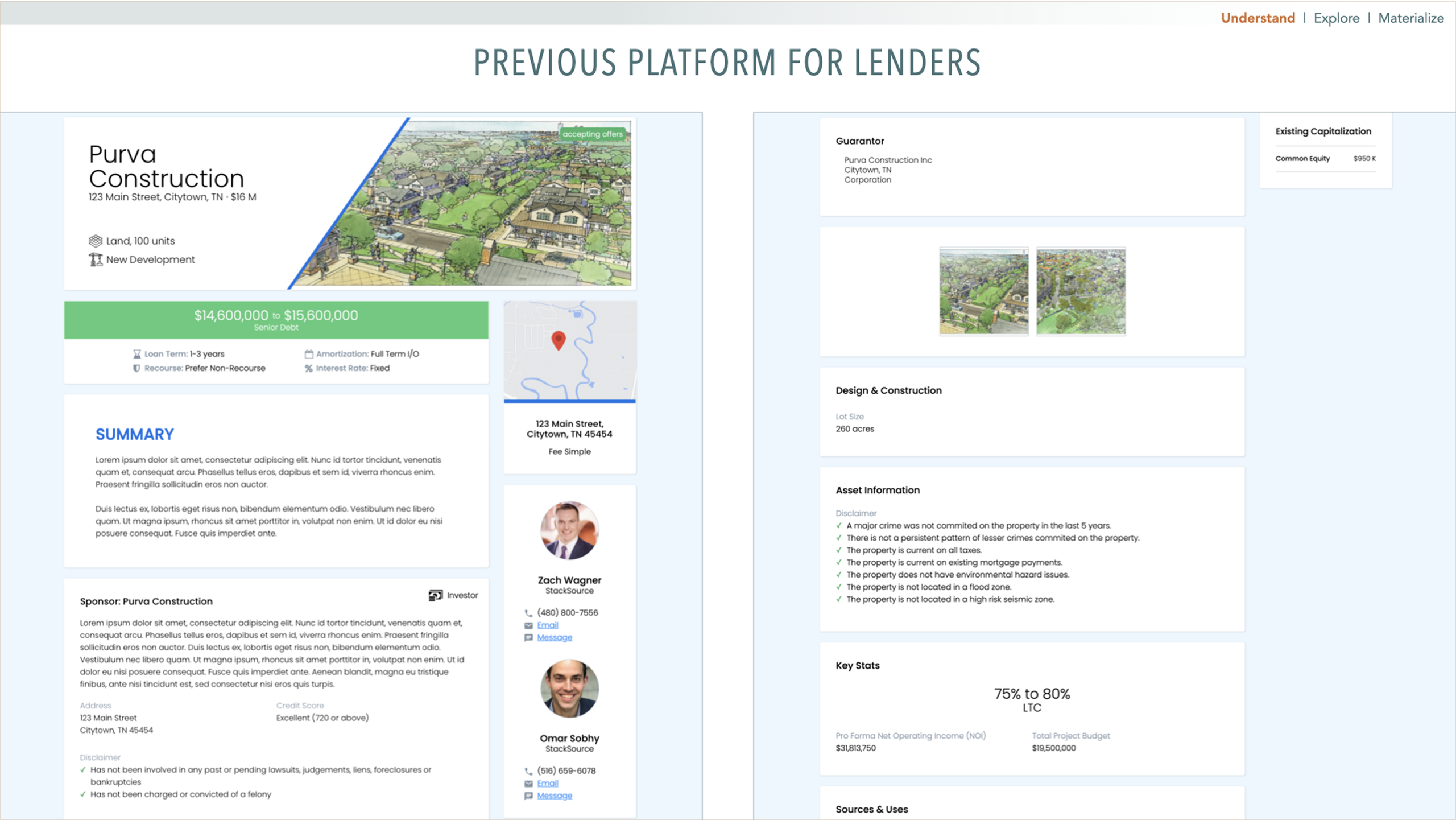

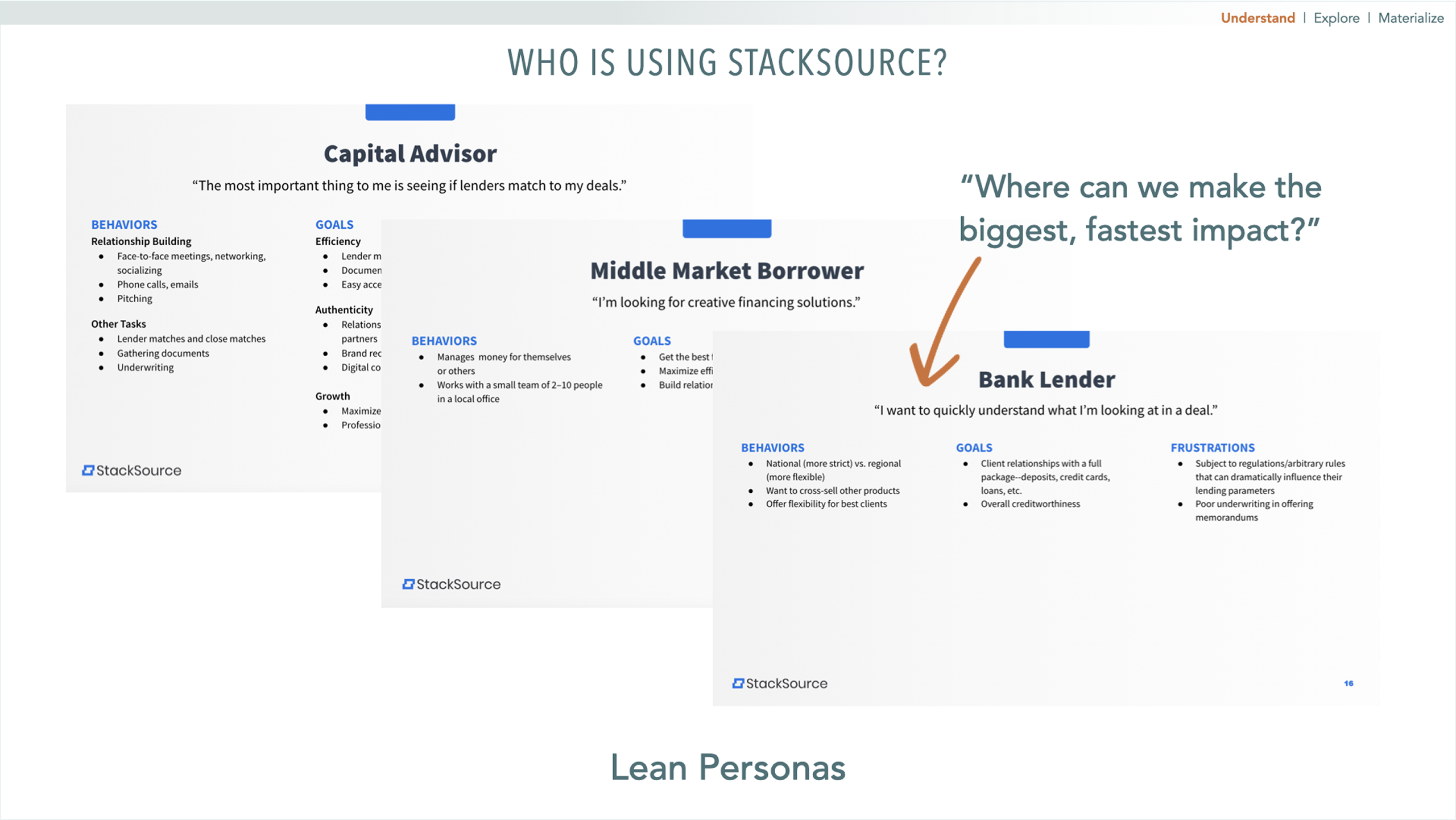

I spent the next few weeks learning how the platform works, and understanding Tim's vision. I facilitated whiteboarding sessions with our team to map out key processes in commercial real estate brokering. And I planned and executed an interview-style qualitative study with our external users, borrowers and lenders, to understand their work and needs in the platform.

Building lean personas

Wrapping up my initial research phase with lean personas, I considered all the data I gathered and realized that prioritizing our lender experience was the right approach. StackSource can't close deals without quoted terms from lenders.

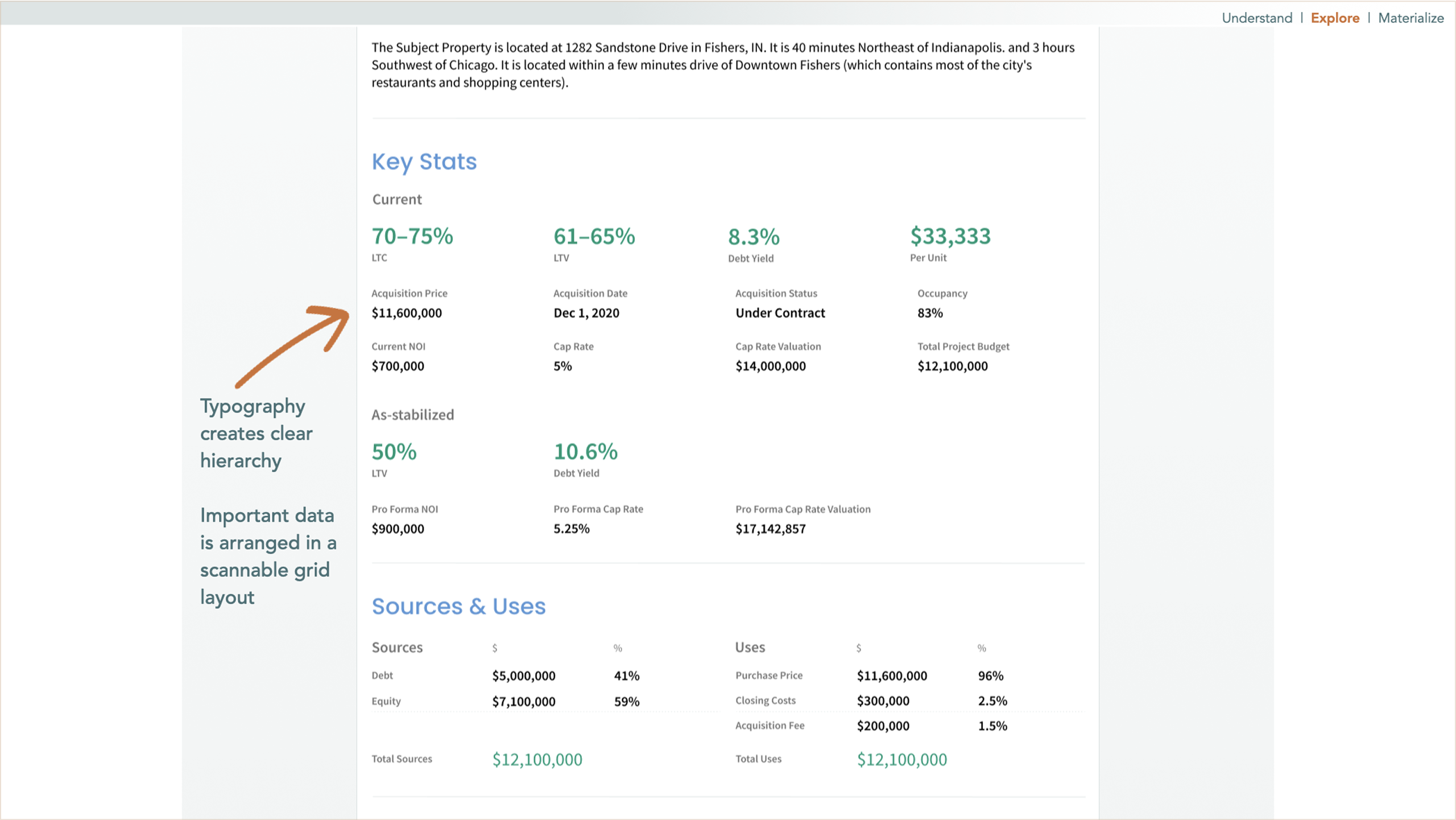

Design considerations

I began designing screens, soliciting feedback, and iterating. While the design has other feature enhancements based on feedback, I focused on key user feedback themes of hierarchy, scannable data, and responsive design. StackSource is now the only responsive CRE financing platform amongst our closest competitors.

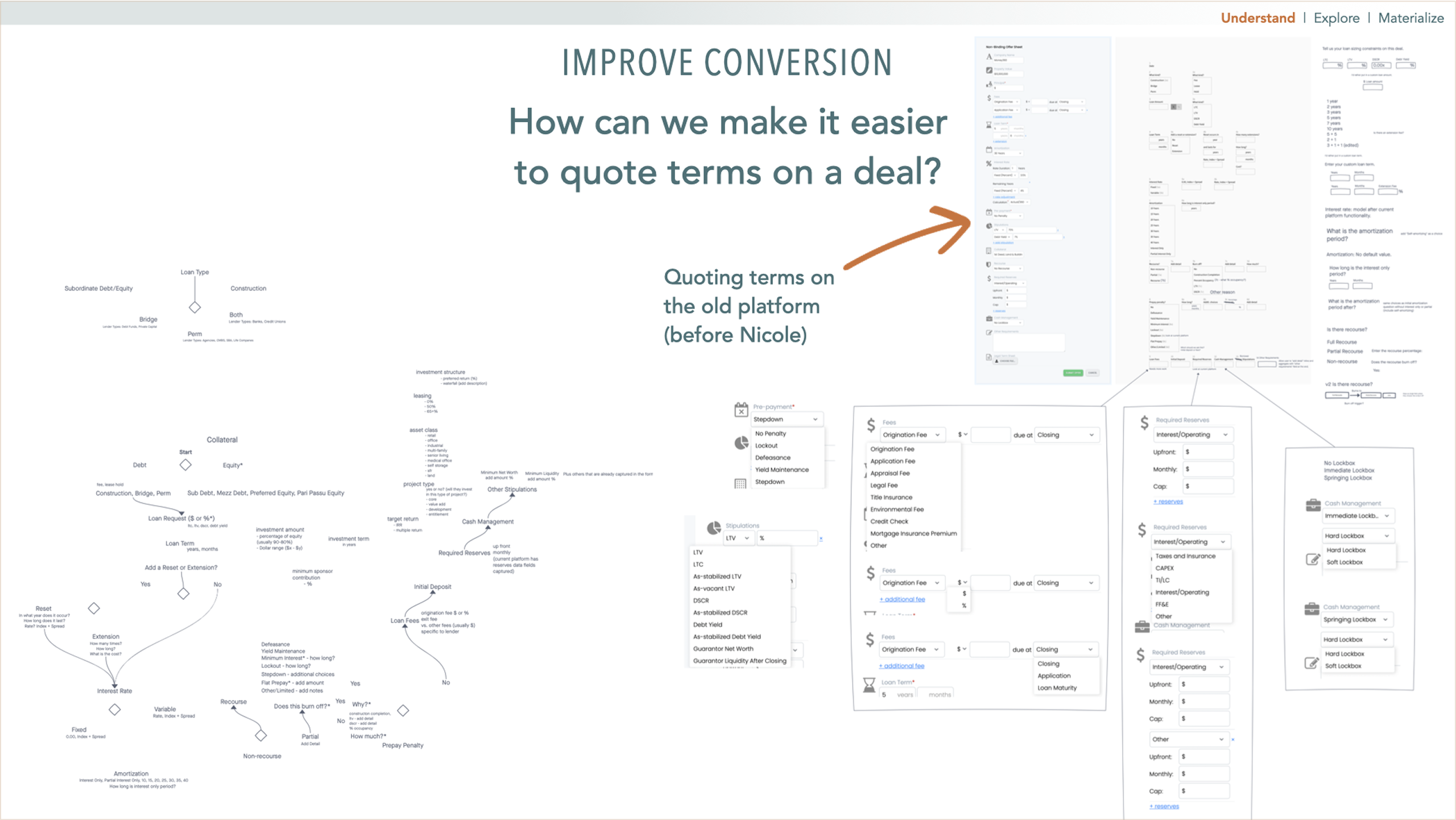

Quoting terms and conversions

Now that lenders more easily understand our deals, they may be more likely to quote. But quoting terms on the old platform required using a lengthy, clunky form that didn't provide a great experience. I believed we had an opportunity to make quoting terms faster and easier. I conducted several whiteboarding sessions with my team to understand the specific calculations and permutations in this complex process.

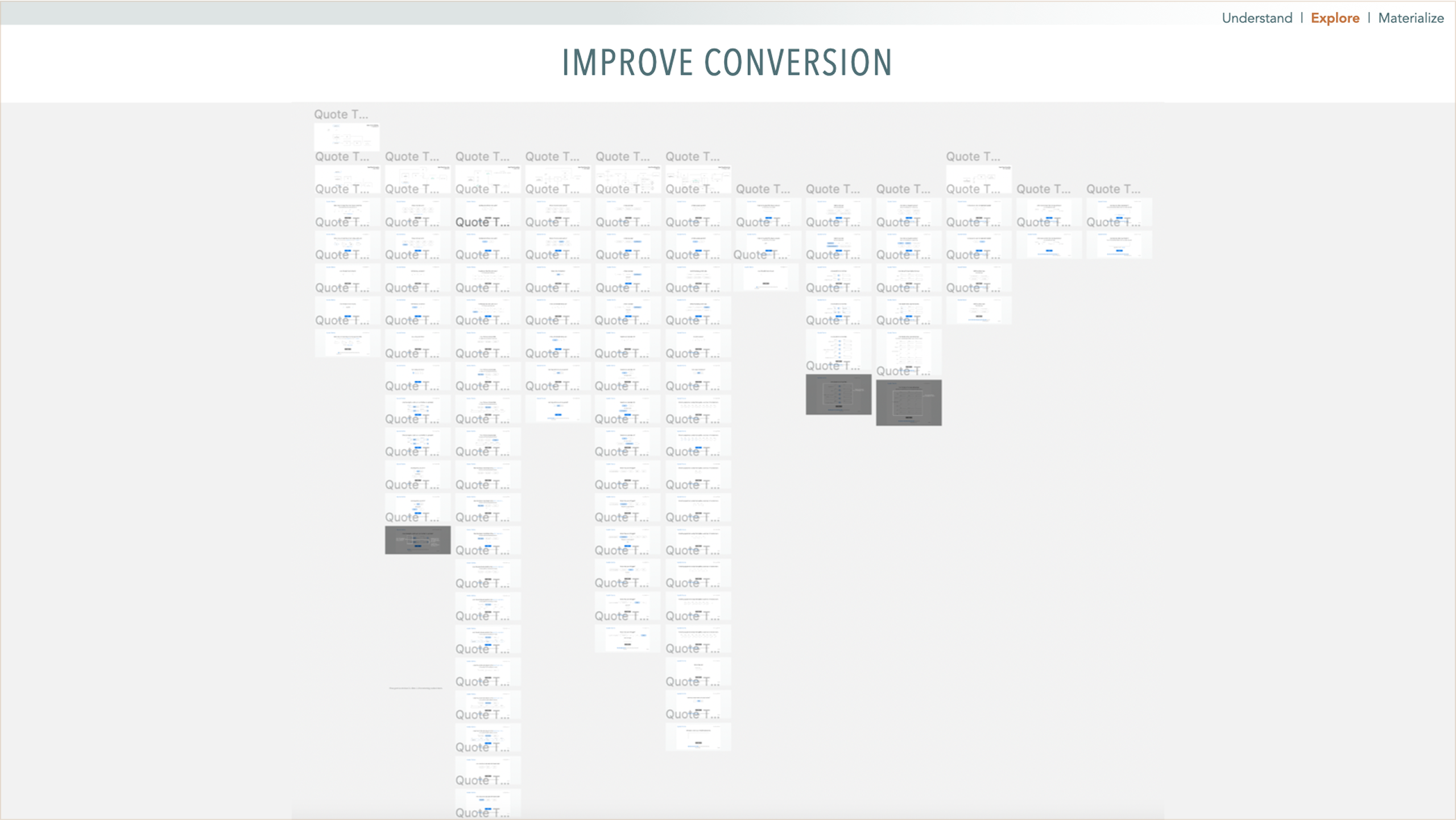

Screen design & prototyping

I conducted prototype testing with several design iterations. A strategy that helped me finalize the design was to recruit users that were internally known to be less savvy, and therefore more likely to introduce errors. Here's a bird's eye view of the screens involved in this process.

Final product

Watch a lender quote terms in about 2 minutes using the new experience in the video.

Launch and beyond

After launch, I continued to solicit feedback and watch user sessions to find opportunities for further improvement.

Impact

The speed at which conversions are happening continues to decrease, and we saw our highest number of unique quotes to date after launch. We have increasing numbers of mobile users now that we've provided a responsive experience. And we know that deal evaluation is faster and easier because our users are telling us.

Result: $1 billion closed

We gave our users a quick and easy experience with an innovative platform design that has an unprecedented quoting engine and is fully responsive. And our business results prove the impact.